As we delve into Employee Health Insurance Costs in 2025: What Employers Should Expect, a fascinating journey unfolds, offering insights that are both informative and thought-provoking. This exploration of future trends in health insurance costs promises to be engaging and enlightening.

In the following paragraph, we will provide a detailed overview of the topic, shedding light on the key factors and trends shaping employee health insurance costs in the year 2025.

Factors Influencing Employee Health Insurance Costs

In 2025, several factors are expected to influence the costs of employee health insurance. Understanding these factors is crucial for employers to prepare for potential changes in healthcare expenses.

Healthcare Policies

Changes in healthcare policies can have a significant impact on insurance costs. For example, if new regulations require insurers to cover additional services or treatments, premiums may increase to cover these added expenses. On the other hand, policies that promote preventive care and wellness programs could potentially lower overall healthcare costs, leading to more competitive insurance pricing for employers.

Technology Advancements

The role of technology in shaping insurance pricing cannot be understated. Advancements in telemedicine, data analytics, and wearable health tracking devices can improve health outcomes and reduce the frequency of costly medical interventions. Insurers may adjust premiums based on the adoption of these technologies by employees, incentivizing healthier behaviors and ultimately lowering insurance costs for employers.

Trends in Employee Health Insurance Costs

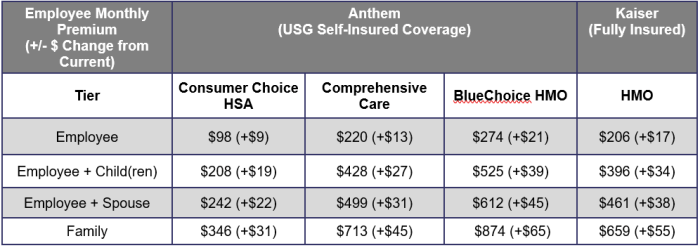

Employee health insurance costs have been on the rise in recent years, driven by factors such as increasing healthcare prices, the aging population, and advances in medical technology. Employers have been grappling with the challenge of providing comprehensive health coverage to their employees while managing the associated costs.

Current Trends

- Health insurance premiums have been steadily increasing, outpacing the rate of inflation.

- Employers are offering high-deductible health plans as a cost-saving measure, shifting more of the financial burden to employees.

- Rising prescription drug costs continue to be a major contributor to overall health insurance expenses.

- The prevalence of chronic conditions among employees is driving up healthcare utilization and costs.

Projections for 2025

- Experts predict that health insurance costs will continue to rise, albeit at a slightly slower pace compared to previous years.

- Advancements in telemedicine and digital health solutions may help to curb costs by providing more cost-effective healthcare options.

- Employers may explore innovative insurance models, such as value-based care arrangements, to better manage costs while improving health outcomes.

Historical vs. Future Trends

- Historically, health insurance costs have increased steadily, with double-digit percentage growth in some years.

- Future trends suggest a more gradual increase in costs, driven by a shift towards preventive care and wellness programs.

- Employers are expected to focus more on employee well-being and proactive health management to contain costs in the long run.

Strategies for Employers to Manage Health Insurance Costs

Employers can implement several cost-saving strategies to manage health insurance expenses effectively. One key approach is to focus on promoting employee wellness through various programs and initiatives. Additionally, leveraging telemedicine and remote healthcare services can also play a significant role in reducing overall costs.

Implementing Wellness Programs

Wellness programs are designed to encourage employees to adopt healthier lifestyles and behaviors, ultimately leading to reduced healthcare costs. Employers can offer incentives such as gym memberships, healthy eating options, and on-site fitness classes to promote employee well-being. By investing in preventive care and wellness initiatives, employers can lower the likelihood of employees needing expensive medical treatments, thus saving on insurance expenses in the long run.

Impact of Telemedicine and Remote Healthcare

Telemedicine and remote healthcare services allow employees to access medical care and consultations without the need for in-person visits. This not only provides convenience but also reduces healthcare costs associated with traditional office visits and emergency room trips. Employers can partner with telemedicine providers to offer virtual healthcare options to their employees, leading to cost savings for both the employer and the employee.

Legal and Compliance Considerations for Employers

Health insurance is an essential benefit that many employers offer to attract and retain top talent. However, there are legal requirements and compliance issues that employers must navigate when providing health insurance coverage to their employees. Failure to comply with these regulations can lead to potential penalties and repercussions for employers.

Legal Requirements for Offering Health Insurance to Employees

Employers with a certain number of full-time employees are required by law to offer health insurance coverage as part of their benefits package. The Affordable Care Act (ACA) mandates that large employers with 50 or more full-time employees must provide affordable health insurance options that meet minimum essential coverage requirements.

Additionally, employers must comply with other regulations such as providing employees with information about their health insurance options, including eligibility criteria, coverage details, and enrollment periods. Failure to meet these legal requirements can result in penalties and fines for employers.

Compliance Issues Related to Health Insurance Coverage

Employers must ensure that their health insurance plans comply with all relevant regulations, including the ACA's requirements for minimum essential coverage, affordability, and minimum value. Failure to offer compliant health insurance coverage can lead to compliance issues and potential legal consequences.

Other compliance issues may arise when it comes to reporting requirements, such as providing employees with Form 1095-C to report health insurance coverage information to the IRS. Employers must also ensure that their health insurance plans do not discriminate against employees based on factors such as age, gender, or pre-existing conditions.

Potential Penalties for Non-compliance with Health Insurance Regulations

Employers who fail to comply with health insurance regulations may face penalties and fines imposed by the IRS or other regulatory agencies. Penalties can vary depending on the nature and severity of the non-compliance, but they can add up quickly and have a significant impact on a company's bottom line.

Some common penalties for non-compliance with health insurance regulations include fines for failing to offer affordable coverage, penalties for not providing adequate coverage to full-time employees, and repercussions for failing to submit required documentation or reports in a timely manner.

Ending Remarks

Concluding our discussion on Employee Health Insurance Costs in 2025: What Employers Should Expect, we recap the essential points and leave you with a comprehensive understanding of the challenges and opportunities that lie ahead in managing health insurance expenses.

FAQs

What factors might impact health insurance costs in 2025?

Factors such as healthcare policies, technology advancements, and economic conditions could play a significant role in influencing health insurance costs in 2025.

How can employers manage health insurance costs effectively?

Employers can implement cost-saving strategies, wellness programs, and utilize telemedicine to effectively manage health insurance costs.

What are the legal requirements for offering health insurance to employees?

Employers are required to comply with certain legal obligations when providing health insurance to employees, including meeting minimum coverage standards and adhering to regulations.

What penalties could employers face for non-compliance with health insurance regulations?

Non-compliance with health insurance regulations could result in potential penalties, fines, or legal consequences for employers, highlighting the importance of staying informed and compliant.